by Thomas W. Hazlett

Financial Times

March 29, 2011

The US Federal Communications Commission, seeing the internet as a fragile ecosystem under threat from opportunistic internet service providers, issued its “network neutrality” order on December 23. By January 10 it had received its first complaint – against an upstart wireless competitor providing innovative services, advanced technologies and new options for low-income consumers.

The targeting of socially valuable entrepreneurship is not an accident. The regulatory effort – “preserving the open internet” – as the FCC labels its regime, mistakes the benefits of market competition for designs of market planners.

The FCC sees danger lurking in the broadband ISP. It will steer you to websites it prefers, pocketing extra fees, either by flat-out blocking your path to others, or by “covertly blocking or degrading internet traffic” to rival sites. Special delivery deals – some sites working better than others – are seen as barriers for new, small-scale players in content and applications. “The harms that could result from threats to openness are significant and likely irreversible,” intones the FCC.

Regulation is to the rescue. ISPs will not be allowed to block access to (legal) websites, or unreasonably discriminate in the way traffic flows. Customers choose. ISPs are open. The network is neutral. What’s not to like?

More

Ungated version

A blog on law, economics, institutions (formal and informal), rational choice and game theory, designed by Prof. Aristides N. Hatzis (University of Athens).

Wednesday, March 30, 2011

Tuesday, March 29, 2011

Τι προβλέπει ο νόμος για τους... νόμους

Το Βήμα

29 Μαρτίου 2011

Δίχτυ ελέγχου του νομοθετικού έργου, με τη θέσπιση κανόνων διαφάνειας στην κατάρτιση και επεξεργασία των ρυθμιστικών πράξεων, επιχειρεί να απλώσει η κυβέρνηση με σχετικό νομοσχέδιο που εισηγήθηκε την περασμένη εβδομάδα στο Υπουργικό Συμβούλιο ο υπουργός Εσωτερικών κ. Ι. Ραγκούσης, και αναμένεται σύντομα να δοθεί προς δημόσια διαβούλευση πριν έρθει προς ψήφιση στη Βουλή.

Με το νομοσχέδιο με το οποίο αποκτούν και «θεσμική ταυτότητα» σχετικές οδηγίες που έχει αποστείλει ήδη προς όλους τους υπουργούς ο Γραμματέας της Κυβέρνησης κ. Σωτήρης Λύτρας, θεσπίζονται συγκεκριμένοι κανόνες και αρχές που θα διέπουν την νομοθετική παραγωγή όλων ανεξαιρέτως των μελών του Υπουργικού Συμβουλίου.

Η νομοθετική αυτή πρωτοβουλία του κ. Ραγκούση, υλοποιεί, μεταξύ των άλλων, σχετικές δεσμεύσεις που έχει αναλάβει η χώρα μας απέναντι στην τρόικα για τη μεταρρύθμιση του.

Η έκθεση εντάσσεται στο πλαίσιο της αξιολόγησης της πολιτικής για την καλή νομοθέτηση 15 κρατών-μελών της Ευρωπαϊκής Ένωσης μετά και από σχετικό αίτημα της Ευρωπαϊκής Επιτροπής.

Περισσότερα

29 Μαρτίου 2011

Δίχτυ ελέγχου του νομοθετικού έργου, με τη θέσπιση κανόνων διαφάνειας στην κατάρτιση και επεξεργασία των ρυθμιστικών πράξεων, επιχειρεί να απλώσει η κυβέρνηση με σχετικό νομοσχέδιο που εισηγήθηκε την περασμένη εβδομάδα στο Υπουργικό Συμβούλιο ο υπουργός Εσωτερικών κ. Ι. Ραγκούσης, και αναμένεται σύντομα να δοθεί προς δημόσια διαβούλευση πριν έρθει προς ψήφιση στη Βουλή.

Με το νομοσχέδιο με το οποίο αποκτούν και «θεσμική ταυτότητα» σχετικές οδηγίες που έχει αποστείλει ήδη προς όλους τους υπουργούς ο Γραμματέας της Κυβέρνησης κ. Σωτήρης Λύτρας, θεσπίζονται συγκεκριμένοι κανόνες και αρχές που θα διέπουν την νομοθετική παραγωγή όλων ανεξαιρέτως των μελών του Υπουργικού Συμβουλίου.

Η νομοθετική αυτή πρωτοβουλία του κ. Ραγκούση, υλοποιεί, μεταξύ των άλλων, σχετικές δεσμεύσεις που έχει αναλάβει η χώρα μας απέναντι στην τρόικα για τη μεταρρύθμιση του.

Η έκθεση εντάσσεται στο πλαίσιο της αξιολόγησης της πολιτικής για την καλή νομοθέτηση 15 κρατών-μελών της Ευρωπαϊκής Ένωσης μετά και από σχετικό αίτημα της Ευρωπαϊκής Επιτροπής.

Περισσότερα

The 0.00002% Privacy Solution

by L. Gordon Crovitz

Wall Street Journal

March 28, 2011

A digital milestone was reached last week, with news that more than half of Americans 12 and older now have Facebook accounts. The study by Arbitron and Edison Research raises this question: If most Americans are happy to have Facebook accounts, knowingly trading personal information for other benefits, why is Washington so focused on new privacy laws?

There is little evidence that people want new rules. The Federal Trade Commission has proposed regulations limiting how advertisers use behavioral and other tracking systems to deliver more targeted advertisements. There have been more than 400 formal responses since the FTC issued its plan in December, including many from advertisers hoping self-regulation will keep regulators at bay. Some in Congress want a Do Not Track system similar to the Do Not Call rules that limit nuisance phone calls.

Unlike intrusive telemarketing phone calls, people seem largely relaxed about behavioral targeting. The advertising industry is using a service called TRUSTe, which adds an icon to online advertisements giving consumers the opportunity to learn more about how they are being tracked and to opt out. A recent study by DoubleVerify found that of five billion advertising impressions, only about 100,000, or 0.002%, led to a click on the icon to learn more about the advertising system serving the advertisement. Of the people who clicked to learn more about information being collected about them, only 1% then opted out of behavior targeted advertising.

That's an opt-out rate of just 0.00002%. People seem to have adjusted to this new technology faster than regulators are willing to admit.

There's no doubt that some advertising companies have abused data, as a Wall Street Journal news investigation called "What They Know" made clear. Until recent industry standards, there was little self-regulation or transparency for consumers. This contributed to abuses such as spamming. But there is nothing inherently wrong about using technology to learn more about people.

More

Wall Street Journal

March 28, 2011

A digital milestone was reached last week, with news that more than half of Americans 12 and older now have Facebook accounts. The study by Arbitron and Edison Research raises this question: If most Americans are happy to have Facebook accounts, knowingly trading personal information for other benefits, why is Washington so focused on new privacy laws?

There is little evidence that people want new rules. The Federal Trade Commission has proposed regulations limiting how advertisers use behavioral and other tracking systems to deliver more targeted advertisements. There have been more than 400 formal responses since the FTC issued its plan in December, including many from advertisers hoping self-regulation will keep regulators at bay. Some in Congress want a Do Not Track system similar to the Do Not Call rules that limit nuisance phone calls.

Unlike intrusive telemarketing phone calls, people seem largely relaxed about behavioral targeting. The advertising industry is using a service called TRUSTe, which adds an icon to online advertisements giving consumers the opportunity to learn more about how they are being tracked and to opt out. A recent study by DoubleVerify found that of five billion advertising impressions, only about 100,000, or 0.002%, led to a click on the icon to learn more about the advertising system serving the advertisement. Of the people who clicked to learn more about information being collected about them, only 1% then opted out of behavior targeted advertising.

That's an opt-out rate of just 0.00002%. People seem to have adjusted to this new technology faster than regulators are willing to admit.

There's no doubt that some advertising companies have abused data, as a Wall Street Journal news investigation called "What They Know" made clear. Until recent industry standards, there was little self-regulation or transparency for consumers. This contributed to abuses such as spamming. But there is nothing inherently wrong about using technology to learn more about people.

More

Venture: the economics of baseball

by Alex Keefe and Ashley Gross

WBEZ91.5

March 28, 2011

Amid all the economic news coming out this week, from manufacturing data to housing stats, there's another event that has just as much to do with dollars and cents: Opening Day.

Cable sports pundits and Las Vegas oddsmakers may not be divining a 2011 World Series championship for Chicago, but at least Cubs and White Sox fans won’t have to dish out too much more money to cheer for their chosen home team this season.

The cost for a family of four to attend a baseball game at Chicago’s Major League ballparks will remain nearly flat this season, thanks in part to ongoing sensitivity to the economic downturn, according to Team Marketing Report, a Wilmette-based sports research firm.

The company’s annual Fan Cost Index for baseball will be released Friday, the official Opening Day of the regular season. The index adds up the costs for two adults and two children to attend a Major League Baseball game: tickets, soda, beer, hot dogs, parking, programs and two souvenir ball caps.

And while Chicago fans may notice only nominal price bumps this season, they may still suffer major league sticker shock when they arrive at Wrigley or U.S. Cellular Field, said Jon Greenberg, who calculates the Fan Cost Index.

“We're not telling you this is what you should spend. We're saying, ‘Look out, this is what it could be,’” Greenberg said.

More

WBEZ91.5

March 28, 2011

Amid all the economic news coming out this week, from manufacturing data to housing stats, there's another event that has just as much to do with dollars and cents: Opening Day.

Cable sports pundits and Las Vegas oddsmakers may not be divining a 2011 World Series championship for Chicago, but at least Cubs and White Sox fans won’t have to dish out too much more money to cheer for their chosen home team this season.

The cost for a family of four to attend a baseball game at Chicago’s Major League ballparks will remain nearly flat this season, thanks in part to ongoing sensitivity to the economic downturn, according to Team Marketing Report, a Wilmette-based sports research firm.

The company’s annual Fan Cost Index for baseball will be released Friday, the official Opening Day of the regular season. The index adds up the costs for two adults and two children to attend a Major League Baseball game: tickets, soda, beer, hot dogs, parking, programs and two souvenir ball caps.

And while Chicago fans may notice only nominal price bumps this season, they may still suffer major league sticker shock when they arrive at Wrigley or U.S. Cellular Field, said Jon Greenberg, who calculates the Fan Cost Index.

“We're not telling you this is what you should spend. We're saying, ‘Look out, this is what it could be,’” Greenberg said.

More

Monday, March 28, 2011

Τι αλήθεια μας αξίζει;

του Τάκη Μίχα

Protagon.gr

28 Μαρτίου 2011

Όλοι αναμφίβολα γνωρίζουν «τι δικαιούνται» και δεν αφήνουν ευκαιρία να μην το διατυμπανίσουν: καλό μισθό, δωρεάν παιδεία, αξιοπρεπή σύνταξη, δωρεάν νοσοκομειακή περίθαλψη, καθαρό αέρα κλπ κλπ.

Παραδόξως όμως, πολύ δύσκολα θα ανταμώσει κανείς ανθρώπους που προβληματίζονται με ένα πολύ πιο βασικό ερώτημα: «Τι μου αξίζει;» Όχι με τη μεταφυσική θρησκευτική έννοια αλλά με την πρακτική έννοια του «Τι αξίζω για τους συνανθρώπους μου». Είναι με άλλα λόγια οι υπηρεσίες που προσφέρω ή το προϊόν που παράγω χρήσιμο και ελκυστικό στους συνανθρώπους μου έτσι ώστε να έχω ένα κοινωνικό λόγο ύπαρξης; Αυτό το ερώτημα το οποίο σπανίως θέτει κανείς στον εαυτό του είναι πολύ πιο βασικό από οποιοδήποτε αίτημα αναγνώρισης δικαιώματος. Διότι αν δεν προσφέρει κανείς τίποτα το οποίο να επιθυμεί ο υπόλοιπος κόσμος, τότε το μόνο αίτημα που δικαιούται κανείς να διατυπώσει είναι ένα αίτημα ελεημοσύνης και να ελπίζει στην φιλευσπλαχνία των συμπολιτών του.

Για όσους εργάζονται στον ιδιωτικό τομέα η απάντηση στο ερώτημα «τι μου αξίζει» είναι σχετικά εύκολη και δίνεται καθημερινά. Κάθε ημέρα, κάθε ώρα, κάθε λεπτό δισεκατομμύρια ανθρώπων σε όλο τον κόσμο συναποφασίζουν τι αξίζει η υπηρεσία ή το προϊόν που προσφέρεις και η απόφαση τους αυτή σου μεταφέρεται με αστραπιαία ταχύτητα μέσω του μηχανισμού των τιμών. Όσοι περισσότεροι συνάνθρωποί σου επιθυμούν αυτό που προσφέρεις τόσο περισσότερο ανεβαίνει η τιμή του-και αντίστροφα. Όσο πιο ποιοτικό και διαφοροποιημένο από τα άλλα ομοειδή προϊόντα είναι το δικό σου -είτε είσαι ο τενίστας Ρότζερ Φέντερερ είτε ο ποδοσφαιριστής Λιονέλ Μέσι- τόσο πιο πολύ οι συνάνθρωποι σου θα σπεύδουν να αποζητούν τις υπηρεσίες σου. Είναι ιδιαίτερα ενδιαφέρον ότι ποτέ δεν μπορείς να γνωρίζεις εκ των προτέρων τι αξίζεις. Αυτό το μαθαίνεις μόνο εκ των υστέρων. Πρόκειται για μια «διαδικασίας ανακάλυψης» ανάλογη με τις επιστημονικές ανακαλύψεις. Όταν ο δημιουργός της Apple Στιβ Τζομπς είχε την εκπληκτική ιδέα για το ipad οι περισσότεροι πίστευαν ότι θα αποτύχει. Όμως το νέο προϊόν έσπασε ρεκόρ πωλήσεων.

Περισσότερα

Protagon.gr

28 Μαρτίου 2011

Όλοι αναμφίβολα γνωρίζουν «τι δικαιούνται» και δεν αφήνουν ευκαιρία να μην το διατυμπανίσουν: καλό μισθό, δωρεάν παιδεία, αξιοπρεπή σύνταξη, δωρεάν νοσοκομειακή περίθαλψη, καθαρό αέρα κλπ κλπ.

Παραδόξως όμως, πολύ δύσκολα θα ανταμώσει κανείς ανθρώπους που προβληματίζονται με ένα πολύ πιο βασικό ερώτημα: «Τι μου αξίζει;» Όχι με τη μεταφυσική θρησκευτική έννοια αλλά με την πρακτική έννοια του «Τι αξίζω για τους συνανθρώπους μου». Είναι με άλλα λόγια οι υπηρεσίες που προσφέρω ή το προϊόν που παράγω χρήσιμο και ελκυστικό στους συνανθρώπους μου έτσι ώστε να έχω ένα κοινωνικό λόγο ύπαρξης; Αυτό το ερώτημα το οποίο σπανίως θέτει κανείς στον εαυτό του είναι πολύ πιο βασικό από οποιοδήποτε αίτημα αναγνώρισης δικαιώματος. Διότι αν δεν προσφέρει κανείς τίποτα το οποίο να επιθυμεί ο υπόλοιπος κόσμος, τότε το μόνο αίτημα που δικαιούται κανείς να διατυπώσει είναι ένα αίτημα ελεημοσύνης και να ελπίζει στην φιλευσπλαχνία των συμπολιτών του.

Για όσους εργάζονται στον ιδιωτικό τομέα η απάντηση στο ερώτημα «τι μου αξίζει» είναι σχετικά εύκολη και δίνεται καθημερινά. Κάθε ημέρα, κάθε ώρα, κάθε λεπτό δισεκατομμύρια ανθρώπων σε όλο τον κόσμο συναποφασίζουν τι αξίζει η υπηρεσία ή το προϊόν που προσφέρεις και η απόφαση τους αυτή σου μεταφέρεται με αστραπιαία ταχύτητα μέσω του μηχανισμού των τιμών. Όσοι περισσότεροι συνάνθρωποί σου επιθυμούν αυτό που προσφέρεις τόσο περισσότερο ανεβαίνει η τιμή του-και αντίστροφα. Όσο πιο ποιοτικό και διαφοροποιημένο από τα άλλα ομοειδή προϊόντα είναι το δικό σου -είτε είσαι ο τενίστας Ρότζερ Φέντερερ είτε ο ποδοσφαιριστής Λιονέλ Μέσι- τόσο πιο πολύ οι συνάνθρωποι σου θα σπεύδουν να αποζητούν τις υπηρεσίες σου. Είναι ιδιαίτερα ενδιαφέρον ότι ποτέ δεν μπορείς να γνωρίζεις εκ των προτέρων τι αξίζεις. Αυτό το μαθαίνεις μόνο εκ των υστέρων. Πρόκειται για μια «διαδικασίας ανακάλυψης» ανάλογη με τις επιστημονικές ανακαλύψεις. Όταν ο δημιουργός της Apple Στιβ Τζομπς είχε την εκπληκτική ιδέα για το ipad οι περισσότεροι πίστευαν ότι θα αποτύχει. Όμως το νέο προϊόν έσπασε ρεκόρ πωλήσεων.

Περισσότερα

Saturday, March 26, 2011

For Young, the Shock of Old Age Spurs Saving

Wall Street Journal

March 25, 2011

Young people typically don't care about saving for their retirement, since it feels so far away. A Stanford project seeks to close this gap by showing people how they'll look when they are old. WSJ's Jason Zweig explains.

More

March 25, 2011

Young people typically don't care about saving for their retirement, since it feels so far away. A Stanford project seeks to close this gap by showing people how they'll look when they are old. WSJ's Jason Zweig explains.

More

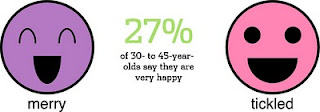

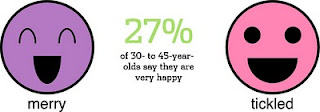

Happy? Statisticians Aren't Buying It

by Carl Bialik

Wall Sreet Journal

March 26, 2011

Governments, academics and pollsters are hot on the trail of happiness.

U.K. Prime Minister David Cameron has launched an initiative to measure the national mood in a way that isn't captured by traditional economic statistics. French President Nicolas Sarkozy and German legislators are looking into similar programs. U.S. government researchers and Gallup pollsters are asking hundreds of thousands of Americans each year how satisfied they are with their lives.

But statisticians' efforts to measure happiness are ridden with uncertainty. Around the world, people tend to describe themselves as happy even when they express many specific complaints and doubts about their lives or their government. Some economists say that even if a reliable happiness test could be devised, it would be risky to craft policy based on a broad metric. Instead, they say, happiness is more reliably reflected in things that are objectively measured, such as income, health and living conditions.

Simon Chapple, senior economist with the Organization for Economic Co-Operation and Development's social-policy division, has doubts about whether it is possible to measure how happiness is influenced by public policy. "This is an academic field in an enormous state of flux," Dr. Chapple says. "Controversy is still out there."

But other economists see little downside in the efforts. Richard Layard, an economist at the London School of Economics, is an advocate of trying to track happiness as "a basic measure of the progress of a society." Its subjectivity isn't a problem, in his view: "The most important things in life are subjective."

More

Wall Sreet Journal

March 26, 2011

Governments, academics and pollsters are hot on the trail of happiness.

U.K. Prime Minister David Cameron has launched an initiative to measure the national mood in a way that isn't captured by traditional economic statistics. French President Nicolas Sarkozy and German legislators are looking into similar programs. U.S. government researchers and Gallup pollsters are asking hundreds of thousands of Americans each year how satisfied they are with their lives.

But statisticians' efforts to measure happiness are ridden with uncertainty. Around the world, people tend to describe themselves as happy even when they express many specific complaints and doubts about their lives or their government. Some economists say that even if a reliable happiness test could be devised, it would be risky to craft policy based on a broad metric. Instead, they say, happiness is more reliably reflected in things that are objectively measured, such as income, health and living conditions.

Simon Chapple, senior economist with the Organization for Economic Co-Operation and Development's social-policy division, has doubts about whether it is possible to measure how happiness is influenced by public policy. "This is an academic field in an enormous state of flux," Dr. Chapple says. "Controversy is still out there."

But other economists see little downside in the efforts. Richard Layard, an economist at the London School of Economics, is an advocate of trying to track happiness as "a basic measure of the progress of a society." Its subjectivity isn't a problem, in his view: "The most important things in life are subjective."

More

Friday, March 25, 2011

Stomach staples: People’s spending choices are a good way to assess levels of hunger

Economist

March 24, 2011

For most people in rich countries hunger is a temporary inconvenience, easily solved by popping out to the shops or raiding the fridge. But chronic hunger is part of everyday life for many people in poorer places. Halving the proportion of people in developing countries who do not get enough to eat is one of the United Nations’ Millennium Development Goals.

Reducing hunger is a complicated task. There is no global shortage of food. Less poverty does not always mean better-nourished people. In India, for example, real incomes rose and the price of food fell between 1980 and 2005. Yet evidence suggests that Indians, even those who were originally eating less than recommended, reduced their calorie consumption in that time. Such findings have long puzzled economists.

A recent paper by two economists, Robert Jensen of the University of California, Los Angeles, and Nolan Miller of the University of Illinois, Urbana-Champaign, suggests that part of the problem may lie in the way governments and international agencies count the hungry. This typically involves fixing a calorie threshold — 2,100 calories per day is a common benchmark — and trying to count how many people report eating food that gives them fewer calories than this number. Since calorific needs differ from person to person, a universal number is clearly only a guide. What’s more, concentrating on calories ignores the important role of micronutrients such as minerals and vitamins. But the economists argue that this approach to measuring hunger also does not accord with how people themselves think about it. They propose a new way to use people’s eating choices to tell whether they are hungry.

More

Read the Paper

March 24, 2011

For most people in rich countries hunger is a temporary inconvenience, easily solved by popping out to the shops or raiding the fridge. But chronic hunger is part of everyday life for many people in poorer places. Halving the proportion of people in developing countries who do not get enough to eat is one of the United Nations’ Millennium Development Goals.

Reducing hunger is a complicated task. There is no global shortage of food. Less poverty does not always mean better-nourished people. In India, for example, real incomes rose and the price of food fell between 1980 and 2005. Yet evidence suggests that Indians, even those who were originally eating less than recommended, reduced their calorie consumption in that time. Such findings have long puzzled economists.

A recent paper by two economists, Robert Jensen of the University of California, Los Angeles, and Nolan Miller of the University of Illinois, Urbana-Champaign, suggests that part of the problem may lie in the way governments and international agencies count the hungry. This typically involves fixing a calorie threshold — 2,100 calories per day is a common benchmark — and trying to count how many people report eating food that gives them fewer calories than this number. Since calorific needs differ from person to person, a universal number is clearly only a guide. What’s more, concentrating on calories ignores the important role of micronutrients such as minerals and vitamins. But the economists argue that this approach to measuring hunger also does not accord with how people themselves think about it. They propose a new way to use people’s eating choices to tell whether they are hungry.

More

Read the Paper

Wednesday, March 23, 2011

People can exercise only so much self-control

USA Today

March 22, 2011

People who overtax their self-control may find they have less in reserve for later, suggests an intriguing new study that may have implications for people trying to lose weight or make other behavioral changes.

But lack of sleep does not appear to affect self-control, say the researchers, whose study of 58 subjects is in the March issue of the journal Social Psychological and Personality Science.

The subjects — half had stayed awake for 24 hours and half were well-rested — were shown scenes involving vomit and excrement from two movies, Monty Python's The Meaning of Life (1983) and Trainspotting (1996).

Some were allowed to express reactions; others were told to show no emotion. Later, they played an aggressive game in which they won or lost by chance. Winners were allowed to blast their opponent with a loud noise.

Those who had suppressed their emotions blasted their opponent at a noise level about 33% higher than those who were allowed to show emotion, regardless of how much sleep they'd had, researchers found.

Results suggest that "people have a diminishable supply of energy that the body and mind use to engage in self-control," says study author Kathleen Vohs, a consumer psychology professor at the University of Minnesota's Carlson School of Management. "When people use this energy toward achieving one goal, they have less of it available to use toward achieving other goals."

More

Read the Paper

[ungated]

March 22, 2011

People who overtax their self-control may find they have less in reserve for later, suggests an intriguing new study that may have implications for people trying to lose weight or make other behavioral changes.

But lack of sleep does not appear to affect self-control, say the researchers, whose study of 58 subjects is in the March issue of the journal Social Psychological and Personality Science.

The subjects — half had stayed awake for 24 hours and half were well-rested — were shown scenes involving vomit and excrement from two movies, Monty Python's The Meaning of Life (1983) and Trainspotting (1996).

Some were allowed to express reactions; others were told to show no emotion. Later, they played an aggressive game in which they won or lost by chance. Winners were allowed to blast their opponent with a loud noise.

Those who had suppressed their emotions blasted their opponent at a noise level about 33% higher than those who were allowed to show emotion, regardless of how much sleep they'd had, researchers found.

Results suggest that "people have a diminishable supply of energy that the body and mind use to engage in self-control," says study author Kathleen Vohs, a consumer psychology professor at the University of Minnesota's Carlson School of Management. "When people use this energy toward achieving one goal, they have less of it available to use toward achieving other goals."

More

Read the Paper

[ungated]

Sunday, March 20, 2011

Europe prepares for governance green paper

Financial Times

March 20, 2011

Next month the European Commission will publish a corporate governance framework for companies, laying out its views on the subject.

The green paper, which is expected to focus on shareholder engagement, boards of directors and the comply-and-explain approach to corporate governance, follows guidance on board effectiveness published by the UK’s Financial Reporting Council earlier this month.

It comes as the role of corporate governance is under increasing scrutiny by politicians and the public after the financial crisis, and follows an EC green paper last summer that focused on corporate governance in financial institutions.

“In the crisis, boards failed to do their job, to carry out checks of high risk strategies pursued by some financial institutions,” says Lutgart Van den Berghe, chairman of the policy committee at the European Confederation of Directors’ Associations.

Not all the blame should be laid at the door of directors. Ms Van den Berghe believes shareholders had a part to play. “They allowed boards to carry out high risk strategies without intervening, including leveraging with high debt levels,” she says. As a result, “confidence in shareholders has been severely shaken. It is clear shareholders have to do more. They are the final monitors of companies and their boards,” she adds.

It is not yet clear what will be on the EU’s list but experts expect stewardship will be one of the issues. A formalised code setting out shareholder duties would be a positive proposal, some institutions say.

Carl Rosen, executive director at the International Corporate Governance Network, hopes the EU “will promote a stewardship code across all 27 countries”.

Greece launches a corporate governance code today, the last of the EU countries to do so (Ireland shares the UK’s code).

More

March 20, 2011

Next month the European Commission will publish a corporate governance framework for companies, laying out its views on the subject.

The green paper, which is expected to focus on shareholder engagement, boards of directors and the comply-and-explain approach to corporate governance, follows guidance on board effectiveness published by the UK’s Financial Reporting Council earlier this month.

It comes as the role of corporate governance is under increasing scrutiny by politicians and the public after the financial crisis, and follows an EC green paper last summer that focused on corporate governance in financial institutions.

“In the crisis, boards failed to do their job, to carry out checks of high risk strategies pursued by some financial institutions,” says Lutgart Van den Berghe, chairman of the policy committee at the European Confederation of Directors’ Associations.

Not all the blame should be laid at the door of directors. Ms Van den Berghe believes shareholders had a part to play. “They allowed boards to carry out high risk strategies without intervening, including leveraging with high debt levels,” she says. As a result, “confidence in shareholders has been severely shaken. It is clear shareholders have to do more. They are the final monitors of companies and their boards,” she adds.

It is not yet clear what will be on the EU’s list but experts expect stewardship will be one of the issues. A formalised code setting out shareholder duties would be a positive proposal, some institutions say.

Carl Rosen, executive director at the International Corporate Governance Network, hopes the EU “will promote a stewardship code across all 27 countries”.

Greece launches a corporate governance code today, the last of the EU countries to do so (Ireland shares the UK’s code).

More

Για ποια Δικαιοσύνη, αλήθεια, μιλάμε;

του Βασίλειου Φλωρίδη

Καθημερινή

20 Μαρτίου 2011

Πριν από δύο μήνες περίπου, είδαμε όλοι στον Τύπο ότι τρεις Αγγλοι βουλευτές τιμωρήθηκαν από αγγλικά δικαστήρια σε ποινές φυλάκισης από 12 έως 18 μήνες για παραποίηση στοιχείων, σχετικά με τις φορολογικές τους δηλώσεις δηλ. για πλασματικά έξοδα από 10.000 έως 35.000 ευρώ, περίπου. Αμέσως μετά οδηγήθηκαν στη φυλακή. Οι δικαστές και εισαγγελείς έκπληκτοι αναρωτηθήκαμε τι είδους ποινική Δικαιοσύνη επιτέλους απονέμουμε εμείς σ' αυτήν τη χώρα. Ποιους Ελληνες πολίτες δικάζουμε και καταδικάζουμε. Ποιοι τελικά είναι αυτοί που καταλήγουν στα σωφρονιστικά καταστήματα. Ας κάνουμε λοιπόν μια ενδοσκόπηση στο δικανικό μας σύστημα.

Το καθεστώς βέβαια που διέπει την ποινική δίωξη των πολιτικών είναι λίγο πολύ γνωστό. Εφτιαξαν ένα Σύνταγμα, το οποίο αντί να είναι ο χάρτης που εξασφαλίζει την ισονομία και ισοπολιτεία σε όλους τους Ελληνες πολίτες, κατάντησε να είναι το εργαλείο για τη συγκάλυψη των εγκλημάτων κάποιων συναδέλφων τους. Αυτό αδικεί και την πλειοψηφία. Το πιο απογοητευτικό όμως είναι ότι οι ελάχιστοι διεφθαρμένοι ακόμη αντιστέκονται σε ό,τι τους απειλεί. Μετράει ακόμη ο λόγος τους.

Περισσότερα

Καθημερινή

20 Μαρτίου 2011

Πριν από δύο μήνες περίπου, είδαμε όλοι στον Τύπο ότι τρεις Αγγλοι βουλευτές τιμωρήθηκαν από αγγλικά δικαστήρια σε ποινές φυλάκισης από 12 έως 18 μήνες για παραποίηση στοιχείων, σχετικά με τις φορολογικές τους δηλώσεις δηλ. για πλασματικά έξοδα από 10.000 έως 35.000 ευρώ, περίπου. Αμέσως μετά οδηγήθηκαν στη φυλακή. Οι δικαστές και εισαγγελείς έκπληκτοι αναρωτηθήκαμε τι είδους ποινική Δικαιοσύνη επιτέλους απονέμουμε εμείς σ' αυτήν τη χώρα. Ποιους Ελληνες πολίτες δικάζουμε και καταδικάζουμε. Ποιοι τελικά είναι αυτοί που καταλήγουν στα σωφρονιστικά καταστήματα. Ας κάνουμε λοιπόν μια ενδοσκόπηση στο δικανικό μας σύστημα.

Το καθεστώς βέβαια που διέπει την ποινική δίωξη των πολιτικών είναι λίγο πολύ γνωστό. Εφτιαξαν ένα Σύνταγμα, το οποίο αντί να είναι ο χάρτης που εξασφαλίζει την ισονομία και ισοπολιτεία σε όλους τους Ελληνες πολίτες, κατάντησε να είναι το εργαλείο για τη συγκάλυψη των εγκλημάτων κάποιων συναδέλφων τους. Αυτό αδικεί και την πλειοψηφία. Το πιο απογοητευτικό όμως είναι ότι οι ελάχιστοι διεφθαρμένοι ακόμη αντιστέκονται σε ό,τι τους απειλεί. Μετράει ακόμη ο λόγος τους.

Περισσότερα

Friday, March 18, 2011

Patent reform: The spluttering invention machine

Economist

March 17, 2011

For all America’s anxieties about its decline as a superpower, its deficits and its weak economy, it can still be proud of its strength as an innovator. Americans make four times as many patent applications per head as Europeans. Patents spur innovation and lay the foundations for future growth, by assuring inventors that they will reap the rewards of their effort and by publicising their discoveries.

But worries have grown that excessive patenting may now be having the opposite effect: businesses and other researchers may be discouraged from innovating in areas that depend heavily on prior discoveries, for fear of being sued for patent infringement. Besides making it too easy to bring patent lawsuits, it is argued, America hands out patents too readily: an often-quoted example is the one granted to Amazon for its “one-click” online-shopping button. Last year the Supreme Court restricted the scope of such business-process patents, but not by enough to satisfy critics.

Big technology companies complain of “patent trolls”—companies that buy lots of obscure patents and then bombard alleged infringers with lawsuits. (The “trolls” argue that by making patents valued they are helping to create a market in invention that will encourage inventors.) Surging patent activity has overwhelmed the US Patent Office, which is taking ever longer to process applications (see chart).

After years of failed attempts to remedy the situation, on March 8th the Senate passed the biggest overhaul to patent law since the 1950s. Its bill would give the patent office the right to set its own fees, and keep all the proceeds (the Treasury swipes some of these now), so it can hire enough examiners to cut its backlog. It would also align America with international practice by granting patents to the first person to file them. Now, they are awarded to the first to invent a product or idea. This was intended to give small inventors a fair chance against big companies better equipped to file applications. But businesses complain about having their patents challenged, years after they were granted, by people claiming to be the original inventor.

More

March 17, 2011

For all America’s anxieties about its decline as a superpower, its deficits and its weak economy, it can still be proud of its strength as an innovator. Americans make four times as many patent applications per head as Europeans. Patents spur innovation and lay the foundations for future growth, by assuring inventors that they will reap the rewards of their effort and by publicising their discoveries.

But worries have grown that excessive patenting may now be having the opposite effect: businesses and other researchers may be discouraged from innovating in areas that depend heavily on prior discoveries, for fear of being sued for patent infringement. Besides making it too easy to bring patent lawsuits, it is argued, America hands out patents too readily: an often-quoted example is the one granted to Amazon for its “one-click” online-shopping button. Last year the Supreme Court restricted the scope of such business-process patents, but not by enough to satisfy critics.

Big technology companies complain of “patent trolls”—companies that buy lots of obscure patents and then bombard alleged infringers with lawsuits. (The “trolls” argue that by making patents valued they are helping to create a market in invention that will encourage inventors.) Surging patent activity has overwhelmed the US Patent Office, which is taking ever longer to process applications (see chart).

After years of failed attempts to remedy the situation, on March 8th the Senate passed the biggest overhaul to patent law since the 1950s. Its bill would give the patent office the right to set its own fees, and keep all the proceeds (the Treasury swipes some of these now), so it can hire enough examiners to cut its backlog. It would also align America with international practice by granting patents to the first person to file them. Now, they are awarded to the first to invent a product or idea. This was intended to give small inventors a fair chance against big companies better equipped to file applications. But businesses complain about having their patents challenged, years after they were granted, by people claiming to be the original inventor.

More

Schumpeter's Hand: The Impact of Banking Deregulation on Economic Growth

Research by Marianne Bertrand

Capital Ideas

March 2011

Many economists have consistently found a strong link between a well-developed financial market and robust economic growth. This suggests that liberalizing a heavily regulated banking system is one way to fuel growth. However, there is a limited understanding about how this relationship works. How would removing government intervention in bank lending decisions lead to a change in firm behavior as well as the structure and dynamics of industries?

The idea of "creative destruction" first noted by economist Joseph Schumpeter plays an important role in this process, according to a study titled "Banking Deregulation and Industry Structure: Evidence from the French Banking Reforms of 1985" by University of Chicago Booth School of Business professor Marianne Bertrand, Antoinette Schoar of the Massachusetts Institute of Technology, and David Thesmar of HEC Paris.

In a deregulated banking system, banks are less willing to provide loans to poorly performing firms, many of which may eventually be forced to close without the help of subsidized loans. In addition, new companies will find it more attractive to enter the market if they know that incumbent firms no longer have easy access to cheap credit. In this competitive environment, a higher rate of entry and exit of companies allows credit to be distributed more efficiently across firms, which, in turn, leads to faster growth.

The deregulation of the French banking industry in 1985 abolished subsidized loans almost entirely and gave banks the freedom to decide which companies to lend to and how much to charge. Competition between banks provided the incentive to sharpen their screening and monitoring practices so that only credit-worthy firms were given loans. Indeed, the study by Bertrand and her co-authors finds that after the reforms, French banks put more emphasis on the credit quality of borrowers when determining loan size and interest rates.

Moreover, companies that belonged to more bank-dependent industries prior to the reform engaged in more cost-cutting and restructuring after deregulation in order to improve their credit rating. Many more firms entered and left the market, especially in industries that relied heavily on bank loans. Stricter lending seems to force underperforming firms to shut down, allowing bank capital to be allocated to its most productive use.

More

Read the Paper

Capital Ideas

March 2011

Many economists have consistently found a strong link between a well-developed financial market and robust economic growth. This suggests that liberalizing a heavily regulated banking system is one way to fuel growth. However, there is a limited understanding about how this relationship works. How would removing government intervention in bank lending decisions lead to a change in firm behavior as well as the structure and dynamics of industries?

The idea of "creative destruction" first noted by economist Joseph Schumpeter plays an important role in this process, according to a study titled "Banking Deregulation and Industry Structure: Evidence from the French Banking Reforms of 1985" by University of Chicago Booth School of Business professor Marianne Bertrand, Antoinette Schoar of the Massachusetts Institute of Technology, and David Thesmar of HEC Paris.

In a deregulated banking system, banks are less willing to provide loans to poorly performing firms, many of which may eventually be forced to close without the help of subsidized loans. In addition, new companies will find it more attractive to enter the market if they know that incumbent firms no longer have easy access to cheap credit. In this competitive environment, a higher rate of entry and exit of companies allows credit to be distributed more efficiently across firms, which, in turn, leads to faster growth.

The deregulation of the French banking industry in 1985 abolished subsidized loans almost entirely and gave banks the freedom to decide which companies to lend to and how much to charge. Competition between banks provided the incentive to sharpen their screening and monitoring practices so that only credit-worthy firms were given loans. Indeed, the study by Bertrand and her co-authors finds that after the reforms, French banks put more emphasis on the credit quality of borrowers when determining loan size and interest rates.

Moreover, companies that belonged to more bank-dependent industries prior to the reform engaged in more cost-cutting and restructuring after deregulation in order to improve their credit rating. Many more firms entered and left the market, especially in industries that relied heavily on bank loans. Stricter lending seems to force underperforming firms to shut down, allowing bank capital to be allocated to its most productive use.

More

Read the Paper

Thursday, March 17, 2011

Steven G. Medema, "The Hesitant Hand: Taming Self-Interest in the History of Economic Ideas"

Adam Smith turned economic theory on its head in 1776 when he declared that the pursuit of self-interest mediated by the market itself--not by government--led, via an invisible hand, to the greatest possible welfare for society as a whole. The Hesitant Hand examines how subsequent economic thinkers have challenged or reaffirmed Smith's doctrine, some contending that society needs government to intervene on its behalf when the marketplace falters, others arguing that government interference ultimately benefits neither the market nor society.

Steven Medema explores what has been perhaps the central controversy in modern economics from Smith to today. He traces the theory of market failure from the 1840s through the 1950s and subsequent attacks on this view by the Chicago and Virginia schools. Medema follows the debate from John Stuart Mill through the Cambridge welfare tradition of Henry Sidgwick, Alfred Marshall, and A. C. Pigou, and looks at Ronald Coase's challenge to the Cambridge approach and the rise of critiques affirming Smith's doctrine anew. He shows how, following the marginal revolution, neoclassical economists, like the preclassical theorists before Smith, believed government can mitigate the adverse consequences of self-interested behavior, yet how the backlash against this view, led by the Chicago and Virginia schools, demonstrated that self-interest can also impact government, leaving society with a choice among imperfect alternatives.

The Hesitant Hand demonstrates how government's economic role continues to be bound up in questions about the effects of self-interest on the greater good.

Steven G. Medema is professor of economics at the University of Colorado Denver. His many books include Economics and the Law: From Posner to Post-Modernism and Beyond (Princeton).

Steven Medema explores what has been perhaps the central controversy in modern economics from Smith to today. He traces the theory of market failure from the 1840s through the 1950s and subsequent attacks on this view by the Chicago and Virginia schools. Medema follows the debate from John Stuart Mill through the Cambridge welfare tradition of Henry Sidgwick, Alfred Marshall, and A. C. Pigou, and looks at Ronald Coase's challenge to the Cambridge approach and the rise of critiques affirming Smith's doctrine anew. He shows how, following the marginal revolution, neoclassical economists, like the preclassical theorists before Smith, believed government can mitigate the adverse consequences of self-interested behavior, yet how the backlash against this view, led by the Chicago and Virginia schools, demonstrated that self-interest can also impact government, leaving society with a choice among imperfect alternatives.

The Hesitant Hand demonstrates how government's economic role continues to be bound up in questions about the effects of self-interest on the greater good.

Steven G. Medema is professor of economics at the University of Colorado Denver. His many books include Economics and the Law: From Posner to Post-Modernism and Beyond (Princeton).

Wednesday, March 16, 2011

Γιατί οι «κάφροι» κυριαρχούν!

του Τάκη Μίχα

Protagon.gr

16 Μαρτίου 2011

Μια από τις πιο ευρύτατα διαδεδομένες απόψεις στον χώρο των φιλάθλων είναι ότι ο παράγων «έδρα» παίζει ένα σημαντικό ρόλο στην έκβαση ενός παιχνιδιού π.χ. ποδοσφαίρου η μπάσκετ. Τα αίτια συνήθως αποδίδονται στην υποστήριξη του κοινού που «ανεβάζει» τους παίκτες καθώς και στην εξοικείωση με το γήπεδο που έχει η ομάδα που παίζει στην έδρα τους. Τις απόψεις αυτές εξετάζουν αναλυτικά σε ένα πρόσφατο βιβλίο τους ο μαθηματικός οικονομολόγος Tobias Moskwitz και ο αθλητικογράφος Jon Wertheim. Τα αποτελέσματα είναι ιδιαιτέρως ενδιαφέροντα.

Κατ’ αρχάς η άποψη ότι η έδρα παίζει ένα σημαντικό ρόλο στην έκβαση ενός παιχνιδιού δεν είναι μύθος. Έτσι π.χ. στο NBA η ομάδα που παίζει στην έδρα της κερδίζει το 54% των αγώνων ενώ στο αμερικανικό κολεγιακό μπάσκετ το 63%. Ανάλογα είναι και τα αποτελέσματα στο ποδόσφαιρο: στο Αγγλικό πρωτάθλημα οι ομάδες που παίζουν στην έδρα τους κερδίζουν στις 63% των περιπτώσεων.

Όμως από την άλλη πλευρά οι λόγοι που θεωρούνται ότι εξηγούν αυτή την έκβαση δεν ισχύουν. Έτσι οι συγγραφείς μετά από εξονυχιστική στατιστική ανάλυση δείχνουν ότι ούτε η «εμψύχωση» των φιλάθλων παίζει κανένα ιδιαίτερο ρόλο, ούτε και η εξοικείωση με το γήπεδο. Ούτε φυσικά παίζει ρόλο η κούραση λόγω ταξιδιού της επισκεπτόμενης ομάδας.

Ο παράγων που παίζει τον καθοριστικό ρόλο είναι οι αποφάσεις του διαιτητή. Οι διαιτητές τείνουν να παίρνουν αποφάσεις σε κρίσιμα σημεία του παιχνιδιού που ευνοούν την ομάδα που παίζει στην έδρα της. Έτσι στους ποδοσφαιρικούς αγώνες οι διαιτητές τείνουν να δίνουν ευκολότερα πέναλτι στην ομάδα που παίζει στην έδρα της, να αποβάλλουν δυσκολότερα παίκτες της και επίσης να ρυθμίζουν τον χρόνο των καθυστερήσεων ανάλογα με τις ανάγκες της ομάδας που παίζει στην έδρα της.

Περισσότερα

Protagon.gr

16 Μαρτίου 2011

Μια από τις πιο ευρύτατα διαδεδομένες απόψεις στον χώρο των φιλάθλων είναι ότι ο παράγων «έδρα» παίζει ένα σημαντικό ρόλο στην έκβαση ενός παιχνιδιού π.χ. ποδοσφαίρου η μπάσκετ. Τα αίτια συνήθως αποδίδονται στην υποστήριξη του κοινού που «ανεβάζει» τους παίκτες καθώς και στην εξοικείωση με το γήπεδο που έχει η ομάδα που παίζει στην έδρα τους. Τις απόψεις αυτές εξετάζουν αναλυτικά σε ένα πρόσφατο βιβλίο τους ο μαθηματικός οικονομολόγος Tobias Moskwitz και ο αθλητικογράφος Jon Wertheim. Τα αποτελέσματα είναι ιδιαιτέρως ενδιαφέροντα.

Κατ’ αρχάς η άποψη ότι η έδρα παίζει ένα σημαντικό ρόλο στην έκβαση ενός παιχνιδιού δεν είναι μύθος. Έτσι π.χ. στο NBA η ομάδα που παίζει στην έδρα της κερδίζει το 54% των αγώνων ενώ στο αμερικανικό κολεγιακό μπάσκετ το 63%. Ανάλογα είναι και τα αποτελέσματα στο ποδόσφαιρο: στο Αγγλικό πρωτάθλημα οι ομάδες που παίζουν στην έδρα τους κερδίζουν στις 63% των περιπτώσεων.

Όμως από την άλλη πλευρά οι λόγοι που θεωρούνται ότι εξηγούν αυτή την έκβαση δεν ισχύουν. Έτσι οι συγγραφείς μετά από εξονυχιστική στατιστική ανάλυση δείχνουν ότι ούτε η «εμψύχωση» των φιλάθλων παίζει κανένα ιδιαίτερο ρόλο, ούτε και η εξοικείωση με το γήπεδο. Ούτε φυσικά παίζει ρόλο η κούραση λόγω ταξιδιού της επισκεπτόμενης ομάδας.

Ο παράγων που παίζει τον καθοριστικό ρόλο είναι οι αποφάσεις του διαιτητή. Οι διαιτητές τείνουν να παίρνουν αποφάσεις σε κρίσιμα σημεία του παιχνιδιού που ευνοούν την ομάδα που παίζει στην έδρα της. Έτσι στους ποδοσφαιρικούς αγώνες οι διαιτητές τείνουν να δίνουν ευκολότερα πέναλτι στην ομάδα που παίζει στην έδρα της, να αποβάλλουν δυσκολότερα παίκτες της και επίσης να ρυθμίζουν τον χρόνο των καθυστερήσεων ανάλογα με τις ανάγκες της ομάδας που παίζει στην έδρα της.

Περισσότερα

Is Happiness Overrated?

by Shirley S. Wang

Wall Street Journal

March 15, 2011

The relentless pursuit of happiness may be doing us more harm than good.

Some researchers say happiness as people usually think of it—the experience of pleasure or positive feelings—is far less important to physical health than the type of well-being that comes from engaging in meaningful activity. Researchers refer to this latter state as "eudaimonic well-being."

Happiness research, a field known as "positive psychology," is exploding. Some of the newest evidence suggests that people who focus on living with a sense of purpose as they age are more likely to remain cognitively intact, have better mental health and even live longer than people who focus on achieving feelings of happiness.

Happiness research, a field known as "positive psychology," is exploding. Some of the newest evidence suggests that people who focus on living with a sense of purpose as they age are more likely to remain cognitively intact, have better mental health and even live longer than people who focus on achieving feelings of happiness.

In fact, in some cases, too much focus on feeling happy can actually lead to feeling less happy, researchers say.

The pleasure that comes with, say, a good meal, an entertaining movie or an important win for one's sports team—a feeling called "hedonic well-being"—tends to be short-term and fleeting. Raising children, volunteering or going to medical school may be less pleasurable day to day. But these pursuits give a sense of fulfillment, of being the best one can be, particularly in the long run.

"Sometimes things that really matter most are not conducive to short-term happiness," says Carol Ryff, a professor and director of the Institute on Aging at the University of Wisconsin, Madison.

"Sometimes things that really matter most are not conducive to short-term happiness," says Carol Ryff, a professor and director of the Institute on Aging at the University of Wisconsin, Madison.

"Eudaimonia" is a Greek word associated with Aristotle and often mistranslated as "happiness"—which has contributed to misunderstandings about what happiness is. Some experts say Aristotle meant "well-being" when he wrote that humans can attain eudaimonia by fulfilling their potential. Today, the goal of understanding happiness and well-being, beyond philosophical interest, is part of a broad inquiry into aging and why some people avoid early death and disease. Psychologists investigating eudaimonic versus hedonic types of happiness over the past five to 10 years have looked at each type's unique effects on physical and psychological health.

More

Wall Street Journal

March 15, 2011

The relentless pursuit of happiness may be doing us more harm than good.

Some researchers say happiness as people usually think of it—the experience of pleasure or positive feelings—is far less important to physical health than the type of well-being that comes from engaging in meaningful activity. Researchers refer to this latter state as "eudaimonic well-being."

Happiness research, a field known as "positive psychology," is exploding. Some of the newest evidence suggests that people who focus on living with a sense of purpose as they age are more likely to remain cognitively intact, have better mental health and even live longer than people who focus on achieving feelings of happiness.

Happiness research, a field known as "positive psychology," is exploding. Some of the newest evidence suggests that people who focus on living with a sense of purpose as they age are more likely to remain cognitively intact, have better mental health and even live longer than people who focus on achieving feelings of happiness.In fact, in some cases, too much focus on feeling happy can actually lead to feeling less happy, researchers say.

The pleasure that comes with, say, a good meal, an entertaining movie or an important win for one's sports team—a feeling called "hedonic well-being"—tends to be short-term and fleeting. Raising children, volunteering or going to medical school may be less pleasurable day to day. But these pursuits give a sense of fulfillment, of being the best one can be, particularly in the long run.

"Sometimes things that really matter most are not conducive to short-term happiness," says Carol Ryff, a professor and director of the Institute on Aging at the University of Wisconsin, Madison.

"Sometimes things that really matter most are not conducive to short-term happiness," says Carol Ryff, a professor and director of the Institute on Aging at the University of Wisconsin, Madison."Eudaimonia" is a Greek word associated with Aristotle and often mistranslated as "happiness"—which has contributed to misunderstandings about what happiness is. Some experts say Aristotle meant "well-being" when he wrote that humans can attain eudaimonia by fulfilling their potential. Today, the goal of understanding happiness and well-being, beyond philosophical interest, is part of a broad inquiry into aging and why some people avoid early death and disease. Psychologists investigating eudaimonic versus hedonic types of happiness over the past five to 10 years have looked at each type's unique effects on physical and psychological health.

More

Mandatory Mediation in Italy? Mamma Mia!

Wall Street Journal

March 14, 2011

Lawyers in Italy are preparing to go on strike Wednesday to protest a new law requiring mediation in commercial cases.

As a way of calling for changes in the law, Italy’s lawyers are being asked to abstain from attending hearings in any civil, criminal, tax, or administrative proceedings, and to send their clients letters urging them to sign a form letter of protest.

The strike—if it takes place—is supposed to end Monday, and has been called for by Italy’s national union of lawyers, the Organismo Unitario dell’Avvocatura Italiana.

It’s worth noting that the strike period in essence extends a long weekend during prime skiing season, as several American blogs have pointed out. Nevertheless, at least one mediation proponent contends that the strike itself is evidence that mediation “is being treated as a serious threat by a constituency with a stake in judicial inefficiencies.”

More

March 14, 2011

Lawyers in Italy are preparing to go on strike Wednesday to protest a new law requiring mediation in commercial cases.

As a way of calling for changes in the law, Italy’s lawyers are being asked to abstain from attending hearings in any civil, criminal, tax, or administrative proceedings, and to send their clients letters urging them to sign a form letter of protest.

The strike—if it takes place—is supposed to end Monday, and has been called for by Italy’s national union of lawyers, the Organismo Unitario dell’Avvocatura Italiana.

It’s worth noting that the strike period in essence extends a long weekend during prime skiing season, as several American blogs have pointed out. Nevertheless, at least one mediation proponent contends that the strike itself is evidence that mediation “is being treated as a serious threat by a constituency with a stake in judicial inefficiencies.”

More

Sunday, March 13, 2011

Irreconcilable Claim: Facebook Causes 1 in 5 Divorces

by Carl Bialik

Wall Street Journal

March 12, 2011

Upon further review, Facebook and marriage aren't incompatible.

In the past two weeks, the idea that the popular social-networking site plays a role in one in five divorces was reported by many news organizations. This wasn't the first time that surprising number has surfaced—it has appeared in news reports periodically for the past year and a half.

Some lawyers do say that they see Facebook and other social media playing a role in divorce these days, as people rediscover old flames online or strike up new relationships that lead them to stray from their marriage vows. But lawyers and marriage researchers say there isn't much evidence to support the notion that social-networking sites actually cause marriages to sputter.

In fact, both the marriage and divorce rate in the U.S. have declined as Internet usage has risen, according to the Centers for Disease Control and Prevention's National Center for Health Statistics. An annual survey of U.K. matrimonial lawyers by the accounting and consulting firm Grant Thornton has found that during the Facebook era, infidelity's role as the primary cause of around one-quarter of divorces has been stable. In an email, a Facebook spokesman called the notion that the site leads to divorce "ludicrous."

Yet the 1-in-5 number has thrived in part because it helps fill a vacuum: There isn't much reliable research about what does cause divorce. Academic researchers don't even agree on how to approach the question. Some have searched for predictive demographic factors, such as age and income. Others have studied married couples' relationships to see which characteristics presage a split. Determining whether a couple is likely to break up, though, is different than identifying the actual cause.

More

Wall Street Journal

March 12, 2011

Upon further review, Facebook and marriage aren't incompatible.

In the past two weeks, the idea that the popular social-networking site plays a role in one in five divorces was reported by many news organizations. This wasn't the first time that surprising number has surfaced—it has appeared in news reports periodically for the past year and a half.

Some lawyers do say that they see Facebook and other social media playing a role in divorce these days, as people rediscover old flames online or strike up new relationships that lead them to stray from their marriage vows. But lawyers and marriage researchers say there isn't much evidence to support the notion that social-networking sites actually cause marriages to sputter.

In fact, both the marriage and divorce rate in the U.S. have declined as Internet usage has risen, according to the Centers for Disease Control and Prevention's National Center for Health Statistics. An annual survey of U.K. matrimonial lawyers by the accounting and consulting firm Grant Thornton has found that during the Facebook era, infidelity's role as the primary cause of around one-quarter of divorces has been stable. In an email, a Facebook spokesman called the notion that the site leads to divorce "ludicrous."

Yet the 1-in-5 number has thrived in part because it helps fill a vacuum: There isn't much reliable research about what does cause divorce. Academic researchers don't even agree on how to approach the question. Some have searched for predictive demographic factors, such as age and income. Others have studied married couples' relationships to see which characteristics presage a split. Determining whether a couple is likely to break up, though, is different than identifying the actual cause.

More

Saturday, March 12, 2011

Japan's Tsunami - The Broken Window Fallacy Returns

by Steven Horwitz

Nightly Business Report

March 11, 2011

The earthquake and tsunamis in Japan have already led otherwise smart people, including economists like Larry Summers, to fall for one of the oldest fallacies in economics: the broken window fallacy. Summers has already said that this may temporarily benefit the Japanese economy. The argument that such disasters are good for economies are as old as the fallacy they rest on.

The fallacy was first identified by the French economist Frederic Bastiat in the 19th century with his story of the young hoodlum who breaks a window in a tailor's shop. The townsfolk grumble about it until one person points out that it means more business for the glazier. They then note that the glazier will spend that income on something else, and that income will in turn get spent and so on. Soon they've convinced themselves that breaking the window is a boon to the town.

Of course the fallacy here is that all of that spending just replaces the very same stream of spending that the tailor could have initiated by buying anything else, but also having a functional window if the boy never breaks it. All the boy does is force the tailor to spend $100 cleaning up a mess rather than actually adding to his wealth.

More

Nightly Business Report

March 11, 2011

The earthquake and tsunamis in Japan have already led otherwise smart people, including economists like Larry Summers, to fall for one of the oldest fallacies in economics: the broken window fallacy. Summers has already said that this may temporarily benefit the Japanese economy. The argument that such disasters are good for economies are as old as the fallacy they rest on.

The fallacy was first identified by the French economist Frederic Bastiat in the 19th century with his story of the young hoodlum who breaks a window in a tailor's shop. The townsfolk grumble about it until one person points out that it means more business for the glazier. They then note that the glazier will spend that income on something else, and that income will in turn get spent and so on. Soon they've convinced themselves that breaking the window is a boon to the town.

Of course the fallacy here is that all of that spending just replaces the very same stream of spending that the tailor could have initiated by buying anything else, but also having a functional window if the boy never breaks it. All the boy does is force the tailor to spend $100 cleaning up a mess rather than actually adding to his wealth.

More

Friday, March 11, 2011

Accounting for the Unaccountable: The Case of Externalities

by Predrag Rajsic

Mises Daily

March 10, 2011

Some theorists claim that externalities are probably the most legitimate reason for state intervention in human interactions. The ethical case for intervention is that it can presumably increase overall economic efficiency. This article demonstrates that, even if one accepts this ethical principle, the usual choice of externality-generating actions that are believed to justify state intervention is purely arbitrary.

In fact, according to the definition of actions with external effects, any human action in a multi-individual society would qualify for regulation under the banner of improving economic efficiency (i.e., internalizing externalities). However, the nature of human existence renders this internalization impossible. Thus, we end up with a paradoxical situation where every action inevitably fails the ethical criterion we have put in front of ourselves.

More

Mises Daily

March 10, 2011

Some theorists claim that externalities are probably the most legitimate reason for state intervention in human interactions. The ethical case for intervention is that it can presumably increase overall economic efficiency. This article demonstrates that, even if one accepts this ethical principle, the usual choice of externality-generating actions that are believed to justify state intervention is purely arbitrary.

In fact, according to the definition of actions with external effects, any human action in a multi-individual society would qualify for regulation under the banner of improving economic efficiency (i.e., internalizing externalities). However, the nature of human existence renders this internalization impossible. Thus, we end up with a paradoxical situation where every action inevitably fails the ethical criterion we have put in front of ourselves.

More

Wednesday, March 9, 2011

Ten Reasons Not to Abolish Slavery

by Robert Higgs

Mises Daily

March 8, 2011

Slavery existed for thousands of years, in all sorts of societies and all parts of the world. To imagine human social life without it required an extraordinary effort. Yet, from time to time, eccentrics emerged to oppose it, most of them arguing that slavery is a moral monstrosity and therefore people should get rid of it. Such advocates generally elicited reactions ranging from gentle amusement to harsh scorn and even violent assault.

When people bothered to give reasons for opposing the proposed abolition, they advanced various ideas. Here are ten such ideas I have encountered in my reading.

More

Mises Daily

March 8, 2011

Slavery existed for thousands of years, in all sorts of societies and all parts of the world. To imagine human social life without it required an extraordinary effort. Yet, from time to time, eccentrics emerged to oppose it, most of them arguing that slavery is a moral monstrosity and therefore people should get rid of it. Such advocates generally elicited reactions ranging from gentle amusement to harsh scorn and even violent assault.

When people bothered to give reasons for opposing the proposed abolition, they advanced various ideas. Here are ten such ideas I have encountered in my reading.

More

Thursday, March 3, 2011

Gender Rules Trip Up Insurers

by Hester Plumridge

Wall Street Journal

March 2, 2011

Discrimination on grounds of sex looks unfair. But it's hard to see how a new ruling against it will benefit either Europe's insurance industry or its consumers. The European Court of Justice says insurers can't offer men and women different priced products. That could lead to higher premiums and lower demand for insurance. It also sets a worrying precedent for the industry in an upcoming debate on age discrimination.

Because women cause fewer car accidents and live longer on average than men, insurers across Europe currently offer them cheaper car insurance, and lower annual income from annuities in retirement, since they'll be drawing on it for longer. The new ruling means equal prices must be offered to both sexes on all insurance products sold from December 2012.

That's bad news for consumers, since insurers say premium increases are likely to be passed on. Young women, among the hardest hit, could see the cost of car insurance rise by a quarter. And because insurers won't know the relative proportions of men and women taking their cover, total price increases could be more than just averaging them our between the sexes. In the U.K., the biggest market for annuities, the use of "unisex" rates could see retirement income fall by 2% or more, estimates the Association of British Insurers.

More

Wall Street Journal

March 2, 2011

Discrimination on grounds of sex looks unfair. But it's hard to see how a new ruling against it will benefit either Europe's insurance industry or its consumers. The European Court of Justice says insurers can't offer men and women different priced products. That could lead to higher premiums and lower demand for insurance. It also sets a worrying precedent for the industry in an upcoming debate on age discrimination.

Because women cause fewer car accidents and live longer on average than men, insurers across Europe currently offer them cheaper car insurance, and lower annual income from annuities in retirement, since they'll be drawing on it for longer. The new ruling means equal prices must be offered to both sexes on all insurance products sold from December 2012.

That's bad news for consumers, since insurers say premium increases are likely to be passed on. Young women, among the hardest hit, could see the cost of car insurance rise by a quarter. And because insurers won't know the relative proportions of men and women taking their cover, total price increases could be more than just averaging them our between the sexes. In the U.K., the biggest market for annuities, the use of "unisex" rates could see retirement income fall by 2% or more, estimates the Association of British Insurers.

More

EU Closes Insurers' Gender Rate Gap

Wall Street Journal

March 2, 2011

The European Union's highest court declared illegal the widespread practice of charging men and women different rates for insurance, setting in motion an overhaul of how life, auto and health policies are written across Europe.

Two Belgian men had challenged the higher life-insurance premiums charged to members of their sex, arguing that it was discriminatory. In a ruling Tuesday, the Luxembourg-based European Court of Justice agreed.

The judgment can't be appealed. It will have vast implications: Insurers routinely charge women, who live longer, lower premiums for life insurance; young male drivers, who statistically cause more accidents, pay higher premiums for auto policies.

In short, the victory for equality of the sexes will end up costing women money.

More

March 2, 2011

The European Union's highest court declared illegal the widespread practice of charging men and women different rates for insurance, setting in motion an overhaul of how life, auto and health policies are written across Europe.

Two Belgian men had challenged the higher life-insurance premiums charged to members of their sex, arguing that it was discriminatory. In a ruling Tuesday, the Luxembourg-based European Court of Justice agreed.

The judgment can't be appealed. It will have vast implications: Insurers routinely charge women, who live longer, lower premiums for life insurance; young male drivers, who statistically cause more accidents, pay higher premiums for auto policies.

In short, the victory for equality of the sexes will end up costing women money.

More

Wednesday, March 2, 2011

EU Insurance Ruling: More Pain for Women?

by Vladimir Guevarra

Wall Street Journal

March 1, 2011

To all women out there: Which would you rather have – cheaper or more expensive car insurance? Or if I can sharpen the question a bit, would you pay more for car insurance in the name of the struggle against gender discrimination?

Well, today, the European Court of Justice has answered that for you.

The EU’s highest court declared illegal the widespread practice of charging men and women different rates for insurance, in a major decision which would overhaul the pricing of insurance policies across Europe.

Generally, insurers charge cheaper life and car insurance premiums to women because statistics show that women live longer and cause less car accidents.

But no, the ECJ said that’s gender discrimination and it needs to end by Dec 12, 2012. That means, ladies, you’ll have to get ready for more expensive premiums.

More

Wall Street Journal

March 1, 2011

To all women out there: Which would you rather have – cheaper or more expensive car insurance? Or if I can sharpen the question a bit, would you pay more for car insurance in the name of the struggle against gender discrimination?

Well, today, the European Court of Justice has answered that for you.

The EU’s highest court declared illegal the widespread practice of charging men and women different rates for insurance, in a major decision which would overhaul the pricing of insurance policies across Europe.

Generally, insurers charge cheaper life and car insurance premiums to women because statistics show that women live longer and cause less car accidents.

But no, the ECJ said that’s gender discrimination and it needs to end by Dec 12, 2012. That means, ladies, you’ll have to get ready for more expensive premiums.

More

Tuesday, March 1, 2011

Privacy and the Invisible Hand

by Robert Hahn and Peter Passell

Forbes

February 28, 2011

Some four decades ago, Nobel economist George Akerlof argued that markets didn’t get it right when sellers knew a lot more than their potential customers. In the used car market, for example, buyers can’t readily distinguish lemons from non-lemons without investing in the services of an independent mechanic. So they are forced to assume the worst. Bad cars, in effect, drive the good ones from the market, leaving both buyers and sellers worse off.

To many economists, this problem of “asymmetric” information constituted a solid justification for regulating car sales. State legislators agreed, passing a spate of laws that guaranteed buyers the right to return lemons. But this consumer protection was hardly free: it added to the cost of transactions in the used car market.

What nobody noticed at the time, though, was that one man’s market failure was another’s market opportunity. CarMax pioneered the used-car guarantee, which finessed the information problem. And many other used car dealers followed suit.

These dealers have a strong incentive to discover faults and repair them before they put them up for sale. Of course, guaranteed cars sell for higher prices. But that’s just the point: the market found a way to separate the good cars from the bad ones.

Why are we telling you this? Because, given a little time, markets have a way of fixing themselves in more situations than you might imagine.

More

Forbes

February 28, 2011

Some four decades ago, Nobel economist George Akerlof argued that markets didn’t get it right when sellers knew a lot more than their potential customers. In the used car market, for example, buyers can’t readily distinguish lemons from non-lemons without investing in the services of an independent mechanic. So they are forced to assume the worst. Bad cars, in effect, drive the good ones from the market, leaving both buyers and sellers worse off.

To many economists, this problem of “asymmetric” information constituted a solid justification for regulating car sales. State legislators agreed, passing a spate of laws that guaranteed buyers the right to return lemons. But this consumer protection was hardly free: it added to the cost of transactions in the used car market.

What nobody noticed at the time, though, was that one man’s market failure was another’s market opportunity. CarMax pioneered the used-car guarantee, which finessed the information problem. And many other used car dealers followed suit.

These dealers have a strong incentive to discover faults and repair them before they put them up for sale. Of course, guaranteed cars sell for higher prices. But that’s just the point: the market found a way to separate the good cars from the bad ones.

Why are we telling you this? Because, given a little time, markets have a way of fixing themselves in more situations than you might imagine.

More

Subscribe to:

Posts (Atom)